Starting with Best car insurance coverage options, this paragraph aims to draw in readers with a compelling overview of the topic, setting the stage for what’s to come.

Exploring the various types of coverage, factors influencing decisions, customization options, and best practices for selecting the right plan.

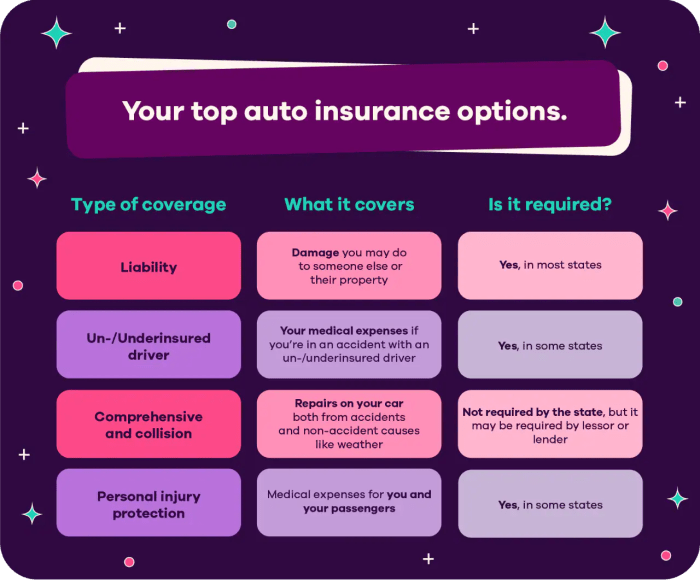

Types of car insurance coverage: Best Car Insurance Coverage Options

When it comes to car insurance coverage, there are several types to consider. Each type offers different levels of protection and benefits.

Liability Coverage

Liability coverage is mandatory in most states and helps cover the costs of injuries and property damage that you cause to others in an accident. It does not cover your own damages.

- Benefits:

- Meets legal requirements

- Protects your assets

- Drawbacks:

- Does not cover your own vehicle damage

- Coverage limits may not be enough in some situations

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

- Benefits:

- Covers a wide range of non-collision damages

- Provides peace of mind

- Drawbacks:

- May have a higher premium

- Usually comes with a deductible

Collision Coverage

Collision coverage helps pay for repairs to your vehicle after a collision with another car or object, regardless of fault.

- Benefits:

- Covers collision-related damages to your car

- Helps get your car back on the road quickly

- Drawbacks:

- May not be necessary for older or low-value vehicles

- Can be costly, especially with a low deductible

Uninsured/Underinsured Motorist Coverage

This type of coverage helps protect you if you are in an accident with a driver who has little or no insurance.

- Benefits:

- Covers medical expenses and property damage

- Provides peace of mind in case of accidents with uninsured drivers

- Drawbacks:

- May not be required in all states

- Could increase your premium

Factors influencing coverage selection

When choosing car insurance coverage, several factors come into play that can significantly impact the decision-making process.

Age, driving history, type of vehicle, and state regulations all play a crucial role in determining the type and amount of coverage a driver may need. Younger drivers or those with a history of accidents may require more comprehensive coverage to protect themselves and their assets. On the other hand, older drivers with a clean driving record may opt for minimal coverage to save on costs.

Personal preferences and budget considerations also influence coverage decisions. Some drivers may prioritize peace of mind and opt for full coverage, while others may choose to take on more risk and go for basic coverage to save money. The value of the vehicle itself can also dictate the level of coverage needed – a brand new luxury car may require more extensive coverage than an older, less valuable vehicle.

For example, in scenarios where a driver has a history of accidents, it would be wise to opt for collision coverage to protect against repair costs. Alternatively, a driver with a brand new car may want to consider gap insurance to cover the difference between the car’s value and the amount owed on a loan in case of a total loss.

Impact of Driver’s Age and Driving History

- Younger drivers or those with a history of accidents may require more comprehensive coverage.

- Older drivers with a clean driving record may opt for minimal coverage to save on costs.

Personal Preferences and Budget Considerations

- Some drivers prioritize peace of mind and opt for full coverage.

- Others may choose basic coverage to save money and take on more risk.

Value of the Vehicle

- A brand new luxury car may require more extensive coverage than an older, less valuable vehicle.

Customizing coverage for individual needs

When it comes to car insurance, one size does not fit all. Drivers have the option to customize their coverage to suit their individual needs, ensuring they have the right protection in place. Let’s explore how drivers can tailor their car insurance based on their lifestyle, usage patterns, and specific requirements.

Add-On Options

- Roadside Assistance: This add-on provides help in case of a breakdown or emergency, offering services like towing, fuel delivery, and tire changes.

- Rental Car Reimbursement: In the event of an accident, this coverage helps cover the cost of renting a vehicle while yours is being repaired.

- Gap Insurance: If your car is totaled in an accident, gap insurance covers the difference between what you owe on your car loan and the car’s actual cash value.

Tailoring Coverage, Best car insurance coverage options

- Usage Patterns: Drivers who use their cars frequently may opt for comprehensive coverage, while those who drive less may choose basic coverage.

- Lifestyle: Individuals with a long commute or who live in high-theft areas may benefit from additional coverage options like uninsured motorist protection.

- Specific Requirements: Customizing coverage means considering factors like the value of your car, your budget, and any unique risks you may face on the road.

Best practices for selecting coverage

When it comes to choosing the best car insurance coverage options, there are a few key practices to keep in mind. By following these tips, you can ensure that you have the right coverage to protect yourself and your vehicle in case of an accident.

Evaluate your coverage needs

Before selecting a car insurance policy, take the time to evaluate your coverage needs. Consider factors such as the value of your vehicle, your driving habits, and your budget. By understanding your specific needs, you can choose the right level of coverage to meet your requirements.

- Assess the value of your vehicle and determine if you need comprehensive or collision coverage.

- Consider your driving habits and commute distance to decide on the appropriate liability coverage limits.

- Review your budget to determine how much you can afford in terms of deductibles and premiums.

Review and adjust your coverage periodically

It’s essential to review your car insurance coverage periodically and make adjustments as needed. Life changes, such as moving to a new location, getting married, or purchasing a new vehicle, can impact your coverage needs. By reviewing your policy regularly, you can ensure that you have adequate coverage at all times.

- Check your coverage at least once a year to make sure it still meets your needs.

- Update your policy if you experience any life changes that could affect your coverage requirements.

- Compare quotes from different insurance providers to ensure you are getting the best deal on your coverage.

Epilogue

In conclusion, understanding the nuances of car insurance coverage options is crucial for making informed decisions that best suit individual needs and circumstances.

Ever wondered what causes your car engine to overheat? There are several reasons why this might happen, from a faulty cooling system to a blown head gasket. To learn more about common car engine overheating causes, check out this informative article: Car engine overheating causes.

Looking for the most fuel efficient vehicles in 2021? With the rising cost of gas, fuel efficiency is more important than ever. Discover the top vehicles that will save you money at the pump in this comprehensive list: Most fuel efficient vehicles 2021.